Are You Looking Reliable Company For Your BBM310 Innovation and Entrepreneurship Assignment ?

Introduction

In an international business environment that has been witnessing a rapid change, entrepreneurship and innovation are extensively perceived as a critical base for competitive advantage to increase the abilities of sustainable business growth, economic activity and countries wealth. One can relate entrepreneurship to get the opportunities discovered, evaluated and exploited in the procedure of business start-up, generation and development (Lounsbury, et al., 2019). The key to the renewal and growth of the economy lies in entrepreneurial activity. Innovation, on the other hand, can be associated to developing, adopting and exploiting value-added activities with the areas of economy and societal – a principal factor for competitiveness and growth. From the lens of entrepreneurship, innovation has the potential to be presented as a discipline, capable of being learned and practiced. The sources of innovation, the changes and their manifestations indicating opportunities for fruitful innovation is needed to be searched by the entrepreneurs apart from knowing and implementing the successful innovation principles. It has been argued by the researchers time and again that innovation must be perceived as a phenomenon – economic or social instead of a term relating to technology. Innovation and entrepreneurship are linked and thus, going hand in hand. The purpose of this group assignment to analyse the competitive forces that operate within an industry by using the Porter’s Five Forces. This will be followed with the secondary activity of analysing an existing business within the chosen industry. Singapore Airlines is selected for this activity.

Selected Industry Sector

Services that are unique are provided by the airline industry by transporting people and goods with an increased level of convenience and efficiency, which any other industry or alternative fails in providing. This industry finds pride in how customers are treated by the airline carriers while travelling by offering luxuries like food, drinks, entertainment, and a welcoming cabin crew. It has been observed that though transportation services are provided in other industries too however, when coming to timeliness, the airline industry outweighs them all. The geological scope of this industry is at an international level. Some airline carriers have the capabilities of flying their aircrafts across the globe whilst a few concentrate on small geographic locations (Berry and Jia, 2010).

a. Porters 5 Forces Research

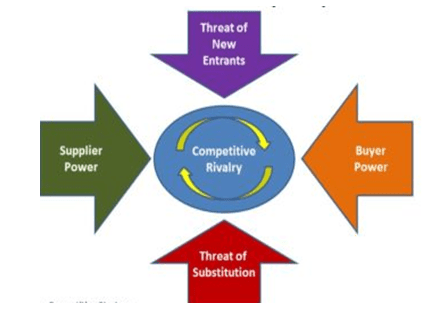

The extensive perspective on the strategies of a company gives base to this framework, meeting the opportunities and threats within and without a specific industry. The five competitive forces that Porter’s has identified comprise of threats of new entrants, bargaining power of suppliers and customers, threat of substitutes, and the rivalry within the industry. Not only is an important base for strategic analysis offered by this analysis, but it also makes contributions in examining the industry’s growth with intent of coming up with potential series of actions.

Figure 1: The Five Force of Industry Competition

The five forces model is one way of getting the very first elemental question in strategic management answered revolving around why few industries are comparatively more appealing than others? For analysing the airline industry all these forces are needed to be looked into.

Buyers Bargaining power: two groups of buyers make up the airline industry namely individual flyers and travel agencies and online portals. The first group purchases plane tickets for several reasons that may be personal or related for business purposes. This buyers group is exceedingly diversified with most people in developed countries having bought an air ticket either from a particular airline directly or via the second group of buyers. This group is working as intermediary amidst the airlines and the flyers. For providing the customers the best possible flight they work together with various airline carriers (Baxter, 2019). Amid these two groups there clearly is a large amount of buyers comparing to the number of airline carriers. The cost of making switch within the airlines is lower as a result of travellers choosing the flight on the basis of where they have to go and ticket price during that period. Though there exist some loyalty towards airlines, but it is not sufficient for higher switching costs. A lot of crucial information is required by every customer such as details of what will they be provided during the flight besides understanding the timing and the general safety forms of flying. Every airline has a niche, providing unique services. There are some airlines focusing on cost whilst others have the focus possessing the best luxuries. Altogether in the airline industry the bargaining power of buyers has a very low threat.

Suppliers Bargaining Power: the manufacturers of the aircrafts are the major suppliers in this case, with Boeing and Airbus currently being the world’s top two manufacturers. The inputs within the airline industry are immensely regulated. This only thing the airline carriers seem to be differentiating is amenities. The aircrafts are very alike. However, efforts are named by some manufacturers at present in making their aircrafts more eco-friendly. It has been observed that suppliers cannot be effortlessly switched by the airline carriers, with most having entered into long-term contracts. Since aircrafts are products of higher capital probably this is why airlines prefer long term loan agreements, having credit terms that are more benign when they do not switch their suppliers. Entering into the aircraft manufacturing industry is difficult owing to the capital required for making an entry. An estimated amount of funds and skill requisite for manufacturing one aircraft is nearly 200 million dollars. This is the key reason behind the airline industry having not many suppliers. The only income source for these manufacturers is airline carriers thus, there business is very important. Hence, it can be said that the bargaining power of suppliers also has a lower threat (Baxter, 2019).

Threat of New Entrants: in the airline industry this aspect has a lower threat. However, there are aspects increasing the level of threat. Firstly, very low switching costs and secondly, no involvement of proprietary products or services. Still the industry as a whole has a very lower threat even with these two aspects. A large cost advantage is enjoyed by the existing players. Huge capital investment is needed in this industry and lack of a strong customer base will reap minimal to zero profit in the initial few years. Airline carriers that already exist can and will utilize their higher capital for retaliating against new players with whatsoever needed say for example, reduced the prices and take a loss. Though there is low switching costs amidst airline carriers, customers have the tendency of choosing brands that are prominent (North, et al., 2019). This has resulted from overpriced air tickets so people do not intend of shelling money on hardly known airlines. There is also the involvement of a huge safety aspect and most customers feel secure with carriers being the industry for a longer time period. Moreover, requirement of plane and flying experience in this industry also reduces the threat of entry. When an airline decides on entering into the market, the very first thing they need to obtain is license, which can be taking nearly a year followed by constant supervision by multiple agencies like the Federal Aviation Administration and the Department of Transportation. Time and capital invested in solely open an airline company is sufficient for preventing most players to enter in this industry.

Threat of Substitutes: the substitute risk level is medium in the airline industry. Other forms of transportation like car, bus, train, or boat can be chosen by the customers for getting to their destination. However, there exists a switching cost. Some modes of transport can be comparatively pricier than an air ticket. Time is the main cost. By far air travelling is the fastest form of transportation that one can avail. Moreover, when coming to cost, convenience, and services at times, all other forms of transport is surpassed by the airlines. Other modes are do chosen by the customers occasionally for different reasons, say for example, cost when the do not have to travel very far (North, et al., 2019).

Rivalry among Existing Players: for various reasons rivalry within the airline industry is very high. At present, the industry is very static further seeming being in the mature stage of the business cycle. Number of competitors’ remains same in the long run, without seeming to being under or over capacitated. Fixed costs in this industry are very higher, making tougher in leaving it as the airlines are possibly in long term loan agreements for staying in the business. Products involved such as aircrafts are greatly complex thereby, heightening the competition and it can be reduced by the brand identities of various airlines (North, et al., 2019). For instance, JetBlue is recognised for its amenities whereas Southwest Airlines is familiar for its lower prices. With each carrier having its own part of the market, it seems that the market share is distributed equally. Also with lower switching costs, a large percentage of the market cannot be held by any one airline.

From the above analysis it can be concluded that competition of the existing players and the power of suppliers are the toughest forces in this industry. Higher rivalry of existing players is likely in driving out any airline not having sufficient capital. Suppliers are strong forces as manufacturing the aircrafts is a costly affair. In case the credit terms are changed by the suppliers by even a smaller amount, it can be meaning a compelling loss for the airline carrier. The other forces that are involved seem in having a weaker threat. Entering the market is both time and cost consuming thus, lowering the risk of entry. As a result of lower switching costs buyers have a weak force whereas substitutes are weak due to being too costly in general. It has been observed that profit is higher in the airline industry resulting from most people flying in need. It is not a trend that is making this industry profit-making for the longer term. Profitable airlines are in a better position because having more aircrafts generally besides a wider variety of flights further providing convenience for the customer.

b. Dynamics in the industry

The restoration of economic optimism across the world since 9/11 has benefited the airline industry. Although the adverse impact of higher oil prices, instability in the Middle East and the current Covid crisis can be seen on the global airline industry, the long term projection is rebounding strongly in traffic growth.

Low-cost and regional airlines

Change is lead by the arrival of low-cost and regional airlines. A robust market performance has been exhibited by the low-cost carriers (LCC) business innovation over recent years, which has added a decisive market value in the airline industry besides getting the customers’ preferences satisfied. LCCs’ business innovation of attaining increased efficiency with reference to passenger load factor, competitive cost devaluation and organizational structure has contributed in getting the market demand fulfilled whilst giving rise to emphatically economical market possibilities for millions of travellers having a limited budget. LCCs’ account for nearly one third of the global air travel industry since 2017. Moreover, by 2025, the market size of low-cost travel is anticipated of exceeding $247 billion. The primary informative variables for this stable market expansion comprises of increased air passenger traffic and measures taken by the budget airlines to enhance efficiency (Park, Lee and Nicolau, 2020).

Impact of globalization

Contributing significantly to the economic, political and social processes, airline is a major industry within itself. It has been observed that demand in airline services unlike it is in the case of other kinds of transport, is a derived one, basing on the need and desire for achieving more ultimate goals. For instance, airlines contributes in a region’s or a specific sector’s economic development such as tourism. Lack of airlines can avert an effective growth just like it happens in the absence of any other economic element (Kholod, et al., 2019). Globalization’s impact on its various displays have been intense for the global airlines industry, not merely on the demand side wherein the scale, nature, and topography of demand in international markets has driven to major transformations, but also on the supply side, where constant and clear international coordination of policies by governments (e.g. safety, security, and environment) and the private sector (e.g. the internationalization of airframe and aero-engine manufacturing) have influenced the institutional and technological environment in which airline services are delivered.

New entrants and substitute products

Risk of new entrants in the airline industry is lower as a result of high barriers to entry such as massive operational costs, several and extremely complicated government regulations a new player should navigate. Not even a 2% market share is held by a single airline commenced in the 21st century. Besides being an industry already saturated, it is it is one of the most big-budgeted industries to function in, and fulfilling the safety requisites only adds to this expense. Meanwhile, risks of substitute products apply only on domestic airlines. International airlines not really have worries about any substitute and hence, it is very lower (Baxter, 2019).

Selected Company within sector

a. Research

With global recognition and a celebrated brand name within the airline industry for nearly 50 years, Singapore Airlines covers around 90 cities in more than forty countries. Being a member of the Star Alliance has contributed in increasing its all over the world to approximately 140 nations. On the whole, the robust brand name of SIA is primarily attributed to its exceptional customer services. Originating from Malayan Airway Ltd. the flag carrier airline of Singapore, nearly four decades since detaching from the former continues in witnessing rapid growth for getting established as a world class airline (Raynes and Tsui, 2019). It has been observed that in the absence of availability of domestic route after it separated from Malayan Airways, SIA was enforced in depending entirely on overseas market that was subjected to intense competition. Singapore Airlines in the face of stiff competition from Malaysia Airlines, China Southern Airlines, AirAsia etc., has positioned the brand as an airline service with premium pricing and a higher quality of service. It has developed airline cost advantages through its relatively high-cost brand strategy by cautiously building a commercial and fixed cost infrastructure empowering them in continuous investments for supporting the brand whilst confronting the competitors on costs. Some £5.2 billion every year is shelled out by SIA in purchasing goods and services from its suppliers. The airline carrier is committed in cultivating a robust and trusted relationship with its supply partners besides boosting the procurement processes efficiency. At SIA goods and services are procured via a strategic sourcing process, making use of benchmarking for ensuring maximum value is attained, both at the point of purchase and over the life of a supply contract (Zaki Ahmed and Rodríguez-Díaz, 2020). A fresh look at its supplier Corporate Responsibility strategy has been taken called ‘Responsible Procurement’ for better comprehending the suppliers CR credentials in-line with SIA’s One Destination’ corporate goals. Utilizing company data and analytics, the airline has revamped its supplier risk assessment and monitoring process. SIA continues in maintaining supplier payment performance around its target of 90 percent of suppliers paid following the conditions agreed mutually. Meanwhile, SIA also enjoys strong customer relationships because of its commitment to help every customer in gaining the best possible experience every time they travel anywhere. The carrier has taken various measures in finding the distinctions of customers’ needs left unaddressed by others through continuing the relationship beyond just booking an air ticket. Campaign highlighting the unique experiences of passengers’ during their flights has been created for celebrating their in-flight experiences connection with rest of their lives. SIA by recognizing that its buyers are more than mere airline passengers have found ways of fitting into their larger ambitions as more than just an airline (Alshurideh, Alsharari and Al Kurdi, 2019).

b. Conclusions

It can be concluded that SIA’s brand positioning has contributed significantly in setting the airline apart from the competition besides focusing on a specified target market and their services accordingly. Moreover, getting the brand positioned against the competitors helps the airline carrier in deciding its service offerings and their prices. Positioning the brand not only has provided SIA with the opportunity of differentiating itself amidst the competitors, but also reflecting its core brand values through communication channels. Managing its relationships with suppliers and buyers has helped SIA in allowing the free-flowing of feedback and ideas. This over time has created a more streamlined and effective chain positively impacting on both costs and customer services.

Conclusions

a. Competitive nature

The airline industry driven by competition, is taking off. An unparallel mixture of choice, competition, access and affordability is benefitting the customers. The biggest of industry players are competing with one another every day as always and the arrival and ever growing demand of low-cost and ultra-low-cost carriers have only added up to this competition. This environment has driven the industry towards innovation, providing new and expanded services and choices for enabling the travellers in customizing their travelling experiences. Functioning in a highly competitive space is good for the airline industry and customers. Getting different players to compete has contributed in fostering investment in all right from new planes to technology advancement and amenities, with customer benefiting from more competition.

b. Attractiveness to existing businesses

It can be concluded from the Porter five forces analysis that an airline is not an attractive industry for being into. Hence, it is not surprising to know that value for its shareholders is not created by the airline industry. Then why still organizations are operating within this industry? The answer to this question lies in the key reason that revolves around higher exit barrier derived from high fixed costs such as aircrafts leasing contracts, contracts with pilots/suppliers etc. To deal with this, competition should be made the main priority by existing businesses like that of Singapore Airlines. It seems other areas on the framework are having an overall lower threat hence, existing businesses do not have to be focusing much in them like their business strategy.