MGMT6015 Assignment Solution

Executive Summary

The following report deals with BHP Billiton and PESTEL analysis of this specific organization in both Australia and the emerging market in Columbia. This will again help in understanding the difference which has evolved due to the importance of differences by taking into account opportunities. In addition, this will help in understanding possible challenges faced by BHP Billiton in international expansion. For framing the discussion, a list of theoretical frameworks like PESTEL, CASE, five force model, and diamond model stand out to be the important framework. Some of the important factors of the Porter-Diamond model are natural resources, capital resources, human resources, scientific knowledge, infrastructure innovation, and technological development. The company works under the leadership of a Dual-listed firm of the two-parent organization named BHP Group PLC and BHP group Limited. The company notion is all about bringing and resources altogether for creating a better world. BHP makes effort to lift its overall productivity which can help in accessing the capital need for new resources and make use of new technology.

Introduction

BHP is known to be a leading resource company involved in extracting and processing minerals, oil, and gases. It has more than 80,000 employees and contractors located in America and Australia. The products of this company are sold globally along with sales and marketing in Houston and Singapore and the United States. The organization comes up with headquarters in Melbourne Australia. In the upcoming years, it is expected that competition for mobile capital will increase (Song, Sun & Jin, 2017). Capital will flow from investment opportunities within Australia when there is a balance between risk and return. The annual revenue of the organization is around 42.9 Billiton dollars and the employee strength of this company is 80,121. BHP Billiton faces tough competition from more than eight companies like Anglo American, BP, Exxon Mobil, ThyssenKrupp AG, Nippon steel, Royal Dutch Shell, Total S.A. In the year 2019, BHP Billiton reported with annual revenue of around 42.9 Billiton dollars from 59 Billiton dollars. The company stands out to be the largest mining firm globally with market capitalization amounting to around 44.07 Billiton dollars for the year 2018 (Pan, Chen & Zhan, 2019). This particular point makes BHP Billiton one of the leading firms in the mining industry.

In the coming pages of the report, an overview has been given regarding descriptive information for either micro and macro environment. An evaluation has been carried out regarding the condition of BHP Billiton for the given emerging market. A list of suggestions has been given to senior management which can help resources and capabilities for navigating into the operational environment so that they can avail the market opportunities.

Country analyses

Micro Environment

Porter five forces Model is defined as strategic management tool which helps in understanding the competitiveness landscape which exits within the industry. Each of the five forces stated within the model can help in creating an understanding of possible profit within the industry. The overall strength of these forces tend to vary from one industry to another (Kara, 2018). This reveals that every industry is found to be different with respect to attractiveness and profitability. Porter Five Forces model is used for carrying out analysis of the industry in which this giant firm BHP Billiton operates. This works with respect attractiveness by gain possible profit. Information analysis by using this model can be availed by strategic planner for BHP Billiton to go for strategic decision-making.

Threat of New Entrants: Economies of scale is found to be bit difficult for achieving within the industry where BHP Billiton works. It ultimately makes easier for those which produces at large capabilities and have cost advantage. This make production much costlier for the new entrants.

Bargaining power of suppliers: The overall number of supplier within industry where BHP works is found to be lot in comparison to Buyers. It reveals that suppliers will have much less control over prices. This again makes bargaining power of suppliers as a weak force.

Bargaining Power of Buyers: Number of suppliers within the industry where BHP Billiton works is found to be much more. The overall numbers of firm that are producing the given product. It reveals that only few firm can choose from and therefore does not have much control over price (de la Rosa et al., 2019). This will again make the bargain power a much weaker force within the whole industry.

Threat of Substitute for product or services: It is one of the few substitutes available for given product within the industry where BHP Billiton works. The given very few substitute are made available by help of low profit earning industries.

Rivalry among the existing organization: The overall competitors within industry where BHP Billiton works are found to be much few. Much of these tend to grow large in size. This reveals that overall number of organization within industry will not go for any move without being noticed.

Heavy Equipment & Engineering in emerging market

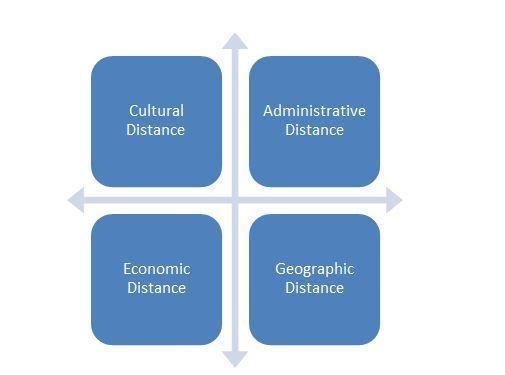

CAGE stands for cultural, administrative, geographic and economic analysis framework which can help manager to identify and analyze the possible impacts. It has founded that CAGE strategy can be used for understanding possibilities instead of achieving the desired goals. Using this CAGE strategy, the internal procedures of BHP Billiton can be taken into account (Patil, 2018). CAGE framework is presented on global scale which exactly reveals the exact degree of trade that exists between the countries.

CAGE framework is completely predicted on the global scale economies so that they can make use of benefits for BHP Billiton from various nation of globe. There are list of recommendation regarding the fact how CAGE framework can help administrator in contemplating the global approach (Öneren, Arar & Yurdakul, 2017). Physical distance tends to have a direct impact for transportation costs, industries which are related to large and bulky goods. Cultural separation tends to affect the tastes of buyers. This framework is found to be important for various entities which lie within steel and cement industry.

Colombia is found to be world fourth largest coal exporter and major supplier for thermal coal. This is used for power generation in Asia and Europe. Colombia is now considered to be as one of the Latin America’s fastest growing market (Fang et al., 2018). This country stands out to be much more secured within the region for performing different business operations. In the last few years, mining companies and explorers tend to focus on South American countries.

Macro Environment

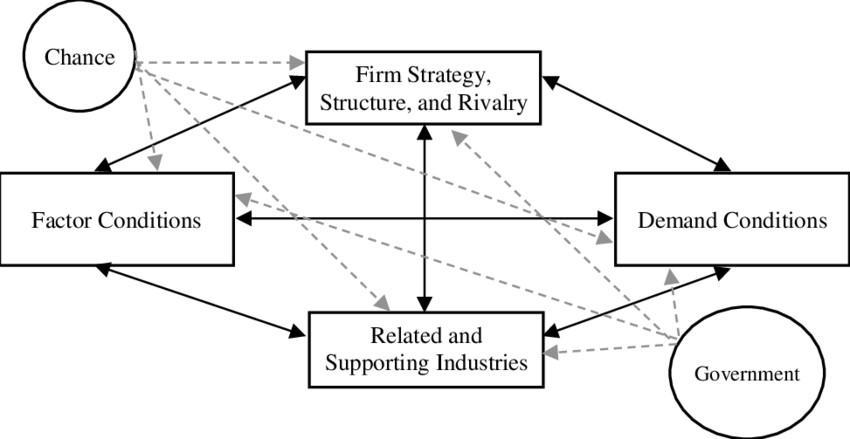

Michael Porter Diamond Model is also known to be theory for competitive advantage for BHP Billiton. This stand out to be strategic tool which can be used by firm to understand and develop some basics for competitive advantage (Vlados, 2019). All this is required for international and its expansion. The strategic model is found in shape of diamond and even comprises of elements within framework which gives an understanding of international competitiveness for organization.

All the given elements within the framework are found to be much interactive. It comprises of firm strategy, rivalry factor condition, demand condition and related and supporting industries (Tsai, Chen & Yang, 2021). For BHP Billion limited, all the given condition and elements are found to be helpful for organization in development of growth on international platform. All these is seen with continuous up-gradation along with innovation. With an emphasis on the given elements and refinement of BHP Billiton has helped the organization to become a growing brand on global platform across different countries.

Fig 2: Porter’s Diamond Model

(Source: Vlados, 2019)

Some of factor conditions are nothing but elements and aspects which give a competitive advantage to industry and related organization. For large organization like BHP Billiton, some of the included factors are

- Natural resources

- Capital resources

- Human resources

- Scientific knowledge

- Technological innovation

- Infrastructure Innovation.

Discussion

PESTEL can be elaborated as Political, Economic, Social-culture, technology, environmental and legal factors. In order to analyze Macro environment condition for BHP Billiton, PESTEL analysis stand out to be an important factor.

Political factor analysis: BHP Billiton is defined as asset of organization which stand out to be an important for business domains (Wonglimpiyarat, 2018). BHP has already submitted huge amount of money to carry out investigation and improvement need in nation where there can be dangerous in terms of Politics. Some of the countries are Mongolia, Western Africa, Congo and Colombia.

Economic factor: BHP Billiton is completely defenseless for various kind of monetary elements related to swelling in operation costs, labor cost, exploration expenses and cost of energy. All these increment have affected the extension design of the organization, improvement activities and productivity of friend (HALİFE, 2020). BHP Billiton stand out to be much reliant for the economy of China for 16% for the revenue of the organization.

Social-Culture factor analysis: BHP Billiton is found to be completely powerless for factors of socio-culture which can help in processing and understanding relationship of some key stakeholders. The organization has founded a new way for expansion in Chile by focusing on specialist’s condition and personal satisfaction.

Technology analysis: The organization solely depends on some technical factors for domains like energy assets, discovery, exploration and efficient mining (Song, Sun & Jin, 2017). BHP Billiton completely depends on use of technology so that they can go for technical exploration of organization.

Environmental: Being an organization of natural resource, BHP Billiton is completely controlling and open strategies inclusive of different protocol. BHP Billiton is solely in charge of present ecological condition currently for drilling and carrying out former mining operations.

Legal: This factor in relation to law can be considered as a hazardous factor for BHP Billiton. BHP has lost a major court decision of Federal within Australia for getting rail access to Western press metal pipes.

In order to make use of natural resources and capabilities, senior management of BHP Billiton has come up with sustainable communities. This stand out to be non-profit organization which has launched Columbia resilience project in the year 2013 (Pan, Chen & Zhan, 2019). It will again help in reducing poverty and increase population group within Colombia.

Conclusion

From the above pages, it can be noted the report deals with BHP Billiton which is a popular Australia heavy metal company. The report has covered a detail background for organization, its business processes, competitiveness, revenue and competition in local market, position and market share. In the country analysis section both micro and macro environmental analysis for BHP Billiton has been done. A complete evaluation has been done for particular country for emerging market in Columbia. The report ends with recommendation to the senior management of BHP Billiton so that they can enhance their business operations within Columbia.

Reference List

de la Rosa, C. B., Bolaños, B. C., Echeverría, H. C., Padilla, R. C., & Ruilova, G. S. (2019). PESTEL analysis with neutrosophic cognitive maps to determine the factors that affect rural sustainability. Case Study of the South-Eastern plain of the province of Pinar del Río. Infinite Study.

Fang, K., Zhou, Y., Wang, S., Ye, R., & Guo, S. (2018). Assessing national renewable energy competitiveness of the G20: A revised Porter’s Diamond Model. Renewable and Sustainable Energy Reviews, 93, 719-731.

HALİFE, H. (2020). Analysis Of Competitiveness of Turkish Textile Sector Based on The Porter’s Diamond Model. Stratejik Yönetim Araştırmaları Dergisi, 3(1), 27-49.

Irfan, M., Zhao, Z. Y., Ahmad, M., Batool, K., Jan, A., & Mukeshimana, M. C. (2019). Competitive assessment of Indian wind power industry: A five forces model. Journal of Renewable and Sustainable Energy, 11(6), 063301.

Kara, E. (2018). A contemporary approach for strategic management in tourism sector: pestel analysis on the city Muğla, Turkey. İşletme Araştırmaları Dergisi, 10(2), 598-608.

Öneren, M., Arar, T., & Yurdakul, G. (2017). Developing competitive strategies based on SWOT analysis in Porter’s five forces model by DANP. Journal Of Business Research-Turk, 9(2), 511-528.

Pan, W., Chen, L., & Zhan, W. (2019). PESTEL analysis of construction productivity enhancement strategies: A case study of three economies. Journal of Management in Engineering, 35(1), 05018013.

Patil, D. A. (2018). Sustainable Bio-Energy through Bagasse Co-Generation Technology: A PESTEL Analysis of Sugar Hub of India, Solapur. Journal of Emerging Technologies and Innovative Research, 5(12), 661-669.

Song, J., Sun, Y., & Jin, L. (2017). PESTEL analysis of the development of the waste-to-energy incineration industry in China. Renewable and Sustainable Energy Reviews, 80, 276-289.

Tsai, P. H., Chen, C. J., & Yang, H. C. (2021). Using Porter’s Diamond Model to Assess the Competitiveness of Taiwan’s Solar Photovoltaic Industry. SAGE Open, 11(1), 2158244020988286.

Vlados, C. (2019). Porter’s diamond approaches and the competitiveness web. International Journal of Business Administration, 10(5), 33-52.

Wonglimpiyarat, J. (2018). The role of government in Porter’s Diamond model: comparative cases of Singapore and Thailand. International Journal of Technology, Policy and Management, 18(1), 73-88.