MIS611 – Information Systems Capstone

Introduction

Being established in the year 1765 in the United Kingdom, Lloyds Bank continued its operation within the borders until the opening of the first office that was established internationally in Paris in 1911. This business management assignment help report talks about how it led to a wave of exponential growth, which could be characterized by many acquisitions covering a good part of the 20th century. Besides its growth as a worldwide banking giant, as seen in the following statistic, Lloyds Bank has also enhanced its presence or existence on the domestic market. The strong performance and steady growth of Lloyds Bank’s retail banking segment were driven by its strong strategic framework which emphasizes customer satisfaction. In 1971 Lloyds Bank Europe has marked a year of consolidation after its merger acquisition with Bank of London and BOLSA, creating Lloyds Bank International (LBI), covering all international activities of its business. In terms of its clients, Lloyds Bank is the UK’s leading bank with good domestic results. As per the researcher, the research on customer assessment has demonstrated that a large proportion of individuals employed by Lloyds Bank are satisfied, as it gets clear from the services provided by Lloyds Bank to their customers.

The promotion of online banking services is considered to be another crucial element of Lloyds Bank’s retail banking policy. The growing trends in the Lloyds Bank online banking can be observed. Lloyds Bank continues to expand the number or percentage of its active online banking customers. For the fact that online banking is always a problem for low-confidence and difficulties in usage, it seems to restrict adoption highlights. Due to such reasons, Lloyds Bank is working on improving the adoption of its online banking services. The organization has also focused on the degree to which it is becoming successful.

However, the management policies and employee treatment within the company are the principal areas of focus. The company has been confirmed to urge employees to focus upon inappropriate promotional practices in order to attract consumers towards purchasing additional products. In case these inappropriate practices are not considered and resolved, these will lead to demotion and even to termination. In addition, employees are not that satisfied with the working situations and managerial policies of the company. These policies are generally better in the case of competitors (HSBC and JPMorgan Chase). Employee satisfaction is better for the competitors. Lloyds Banking Group is significantly weak with respect to its performance. Employees feel more satisfied while working in similar organizations for salaries, job security, work ambiance, and overall management. This reflects the weakness in employees’ treatment and human resource management, in this business management assignment help analysis.

The Brief

Project Scope

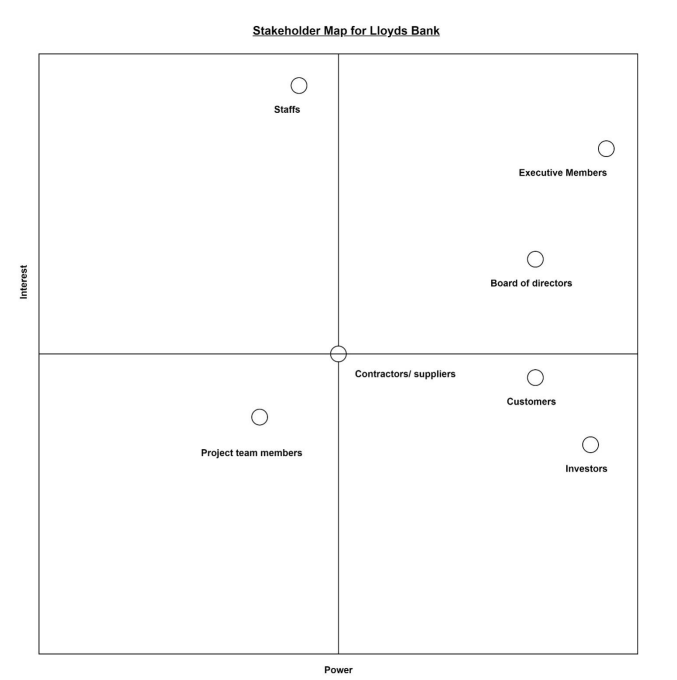

As stated in the introduction part of the business management assignment help project, the company’s internal measures are not quite effective despite its leading position in retail banking as well as the initial measures it follows for entering the commercial banking and pensions segments. The organization’s management processes are weak for the employee maltreatment and consistent pressure on misleading the sales of registered products. These problems limit the operational sustainability in operations by not supporting Principles 4 and 6. These principles are significant for forced labor and mistreatment. Therefore, this business management assignment help paper has its focus on the development of a mechanism that will enhance employee care, administrative efficiency and will eliminate pressure on advisors for participating in any malpractice (Köster, & Pelster, 2017). Hence, it works on improving sustainability.

The Target Audience

Senior executives, employees, and clients or the end-users of Lloyds Bank are considered as the target audience for this business management assignment help project. The inclusion of a computerized recruitment process, along with the training programs, would entail a significant improvement in the current working processes and systems at Lloyds Bank. This includes internal planning and any modifications in the operation areas. It is targeting senior executives and employees (Banyi et al., 2021). The current management and employees will focus on these projects’ steps. If the concerns, expectations, and requirements of these individuals are not taken into account, the probability of success will be significantly reduced. In addition, the initiative would also address supervisors and managers working within the organization. This is for the reason that employee treatment needs some care. Some countermeasures are needed to address discrimination, malpractice for inducingadditional revenue. It requires training and management development and some implementation of feedback mechanisms. These mechanisms will be focusing on employees, teams, and managers.

Project Approach

The agile approach to project management is considered for the proposed business management assignment help project. The project is generally divided into many agile life cycles, which pave the way for stable project execution through repetitive incarnations which vary according to the specifications and external conditions. The reason for selecting the project approach is justified in several ways. According to a few, the agile project approach helps in segregating a complicated project into different segments. Each iteration focuses on producing the best probable outcomes within a stipulated time period. This clears the fact that the agile project approach is capable of facilitating the completion of complicated projects. This can be considered a significant advantage for the project. It has some complex components. It transforms the initial recruitment phase to a completely digitized procedure, employee training and development, and platform development for feedback collection (Kadic-Maglajlic et al., 2019). The agile approach is dividing the project into specific parts. It is facilitating the successful completion of an element and enhancing the chances of success as well as timely completion.

Besides this, there is another significant purpose for the selection of this particular project approach. The digital transformation in banking can be considered a significant element for this. The consideration for digital transformation being a critical aspect will enhance the operations of human resource management and more specifically, employee engagement, performance management, and recruitment. The agile project approach usually goes well with successful projects in software development sectors and IT or Information Technology (Mbama & Ezepue, 2018). Digital transformation within the banking sector somewhat depends on IT advancements and solutions. It makes the project approach remarkable.

In addition, the utilization of the agile project approach in this situation often depends on the assumption that agile approaches will lead to optimum positive results with comparatively low investments. Again, as Lloyds Bank is operating in a competitive industry, it can be stated that low cost and the investment return could help with longevity and performance to maintain corporate competitiveness.

The most significant stakeholders for the business management assignment help project are:

1. Board of Directors of Lloyds Bank

2. Clients or Customers

3. Contractors or Suppliers

4. Investors or Owners or Shareholders

5. Project Team

6. Senior Executives

7. Workers

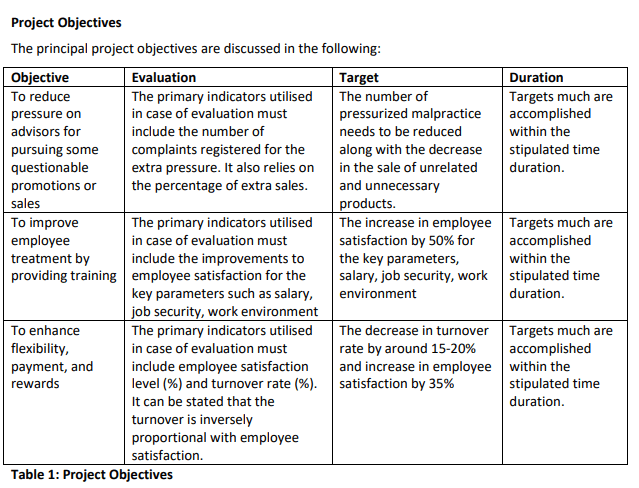

The stakeholders working on the project are being assessed and illustrated in the following stakeholder map:

Figure 1: Stakeholder Map

The stakeholders can be categorized into different divisions discussed as follows:

➢ Low Power, Low Interest: The stakeholders falling into this category are monitored till any changes happen in their position.

➢ Low Power, High Interest: The stakeholders belonging to this category are continuously informed about the latest developments as well as the progress.

➢ High Power, Low Interest: These stakeholders are usually quite satisfied. They understand and fulfill all the requirements.

➢ High Power, High Interest: The stakeholders who fall in this category are managed properly. They have frequent communication for understanding the concerns and requirements (Jha et al., 2017). They inform us about the proceedings and take some actions to resolve all the concerns.

5. STRATEGY FOR COLLECTING DATA

Prior to developing a data collection approach, it is essential to explicitly define the proposal’s data specifications. Below there are some of the key places where knowledge will be required:

a) Customers’ needs and requirements

b) The policies and regulations for the management in the commercial finance companies

c) Workers needs and requirements

d) Digital technologies

e) Latest trends and new strategies for the business

f) Regular progress on the research/project (Harrison & Bazzy, 2017).

The highlighted areas in Figure 4 contain material required ahead of the start of a design and even during its implementation. Given the enormous variety of information available, and the pace at which it has been required (due to the agile technique, which requires new evidence and data every iteration), an intra data collection method that can include various types of data will be necessary (Harrison & Bazzy, 2017).

5.1 Types of Data

a. Primary Data and Secondary Data

This business management assignment help project would necessitate the use of both direct and indirect details. Prior to the start of the project, secondary sources would be especially relevant. Reports, annual reports, research articles, and reputable web publications can offer information on the emerging retail and business banking industry, common industry standards, the status of digitalisation in banking, including group leader and consumer issues. Using such secondary information, a sufficient amount of knowledge can be gathered to create a forum for project management. Collection of primary data, from the other hand, would be a major focus of the research. In prior iterations, coordination with diverse participants (particularly staff at multiple levels around the organisation) would provide a foundation for preparation, but continued contact will enable for the gathering of knowledge that will keep the work on schedule. Similarly, gathering data on project elements and execution would aid in keeping communication lines open, resource use, and mission coordination, allowing for prompt and effective completion.

b. Qualitative Data and Quantitative Data

To determine the scope of the proposal’s criteria and, throughout the long term, track the degree to which they’ve been met, the venture will need both qualitative information. The qualitative approach would include Lloyds Bank’s latest policies, business best practises (in terms of personnel management, employee retention, and fair care of workers), and common worker specifications. Throughout this way, it would be worth noting the business management assignment help project’s importance and to provide an idea of what is really intended to accomplish.

Quantitative data will also aid organising; for example, frequencies and ratios will continue to be useful in highlighting staff demands or the proliferation of emerging technology for banking management (Van Aartsengel & Kurtoglu, 2016). Simultaneously, quantitative approaches can be important in defining goals and priorities, which will make it easier to reflect the project’s demands and aspirations. For example, outlining the amount by which workforce engagement at Lloyds Bank is planned or made to improve during the campaign, or illustrating the number of examples of pressurised negligence after the development of smart technology measures using data collected from participants are examples of numerical methods used to clearly provide a clear picture.

5.2 Sources and Tools necessary for the project

Since the initiative will capture large amounts of information, intermediate, qualitative, and quantitative—a variety of methods and information sources were required. The below is a list of the instruments and sources used in collection of data:

I. Qualitative information can be collected using the secondary information based on the reliable and peer reviewed articles.

II. The quantitative and qualitative data can be collected through deploying the approach of interviews and meetings with different groups of stakeholders.

III. Regular progress data must be collected and reviewed throughout the research. Data collected will be an integral part of this project’s research process. This data would be gathered from records collected by the institution in question, and also some third sources, official documents, research journals, books, and reliable online outlets (Olson et al.,2018). The information will mostly be qualitative, describing the present situation at Lloyds Bank, the continued existence of industrial and wholesale industries, as well as established management and staff care best practises.

Quantitative evidence from independent sources can show insights and changes, providing a solid foundation for contrasting the client’s actual approach and role with the target place (with respect to employee treatment and satisfaction).

Two main instruments will be used to gather primary data. Conversations and consultation with key interested parties will first offer insight on their priorities and needs. This data will serve as the foundation for defining project activities and obligations (O’riordan, 2017). Data gathering, on the other hand, may take place on the ground, with details about the existing operational structure or, after the project has started, about its success. This data may be direct or indirect, and will reveal existing demands and even the extent to which they are being fulfilled.

6. Solution and Functionality

The key complaints about Lloyds Bank’s storage and scheduling of employees have already been stated, with pressurised negligence, but also shortcomings in managerial practise, organisational culture, including job security, among major concerns. A multi approach must be introduced to enhance workplace care and, as a result, their satisfaction. The first layer must focus on the development of new digitalised/ technologically advanced systems that must be considered during the recruitment process or the first phase. The second layer should emphasize the development and training system for management. The third layer must consider the feedback and necessary modification in the system (Dalkir, 2017). The first process of recruiting should be digitised, according to the prescribed scheme. In the beginning phases of recruiting, complete digital technology will enhance applicant selection and minimize the level of human logic and discrimination in candidate recognition including brief. As a result of these steps, the organisation will be able to ensure that only the most qualified employees are recruited (Dalkir, 2017). Around the same time, digital technology of the system and its effect on human performance and judgement during recruiting can work against managers’ ability to assert control over employees. This will help the company eliminate cases of pressured malpractice and foster a corporate atmosphere where employees are not expected to perform such activities.

A framework for staff preparation and development is also included in the second step of the solution. A structure and interface for analysing training requirements would be a core component of this scheme. One of the most critical facets of the training process, according to the author, is training requires review (Maylor& Turner, 2017). The framework would keep track of a curriculum person’s political strengths and disadvantages, outlining the key places where they need training and recommending future training programmes that make training implementation easier (Betta & Boronina, 2018). This platform’s educational programmes would address critical topics like banking ethics, sexism, teamwork, organisational performance, and employee engagement. This could boost management efficiency in a variety of ways, encouraging the company to boost employee loyalty.

Finally, the input and assessment process is the software’s third aspect. It will encourage both employees and managers around the company to express their opinions on management quality and subordinate efficiency (Munro &Ika, 2020). It would also have a way to file complaints of workplace harassment or compelled malpractice. An input evaluation mechanism like this would be crucial because it would enable staff and supervisors to directly report relevant incidents, allowing for quick intervention. Simultaneously, the company could produce a steady stream of data on worker and successful entry, priorities, and grievances. This can open the door to new training plans and programmes, as well as ongoing growth of corporate strategy and organisation.

On the other hand, quality progress will be facilitated by efficient knowledge sharing throughout the network, which will be enabled by strong emphasis and standards. This is primarily based on information management, which is dealing with the application of information from its source in an organisation to its source of use (Cicmilet al.,2017). With a large understanding linking the whole infrastructure and the enterprise, information about the success of each sub-system or commercial area it serves can be easily accessible to all divisions, allowing Lloyds Bank to make quick decisions (Turner, 2016). This would provide for the immediate and appropriate application of responses to environmental stimuli, engaging in continual enhancement in procedures and staff governance.

7.Conclusion and Recommendations

At last this business management assignment help paper concludes that Lloyds Bank is still the leading company in the UK banking sector of the country, and this has adopted steps to enhance its internet presence. However, significant developments in the external climate, such as the emergence of digital innovation in accounting and increasing demand to enhance in the corporate banking business, necessitate rapid transformations and offerings. This necessitates the current program, which aims to boost internet transactions and its acceptance for Lloyds Bank, as well as general operational efficiency in financial services and inclusion in the financial services, retirement, and policy segments, by focusing on business innovation in banking. Following the client’s acceptance of the general design document, data collection procedures, stakeholder evaluation, and suggested solution, the very next steps are adequate data collection including design of the overall project schedule. After that, the solution can be designed, executed, and implemented.

References:

Banyi, T. F., Grimbald, N., Wutofeh, D., Cornelius, W., & Ketuma, H. J. (2021). The Effects of Work Stress on Employees Performance in the Banking Sector of Cameroon: Case of NFC Bank PLC Cameroon. Business and Economic Research, 11(1), 39-58. Betta, J., &Boronina, L. (2018, December). Transparency in Project Management–from Traditional to Agile. In Third International Conference on Economic and Business Management (FEBM 2018). Atlantis Press. Cicmil, S., Cooke-Davies, T., Crawford, L., & Richardson, K. (2017, April). Exploring the complexity of projects: Implications of complexity theory for project management practice. Project Management Institute. Dalkir, K. (2017). Knowledge management in theory and practice. MIT press. Harrison, T., &Bazzy, J. D. (2017). Aligning organizational culture and strategic human resource management. Journal of Management Development. Jha, S., Balaji, M. S., Yavas, U., & Babakus, E. (2017). Effects of frontline employee role overload on customer responses and sales performance: moderator and mediators. European Journal of Marketing. Kadic-Maglajlic, S., Micevski, M., Lee, N., Boso, N., & Vida, I. (2019). Three levels of ethical influences on selling behavior and performance: Synergies and tensions. Journal of Business Ethics, 156(2), 377-397. Köster, H., & Pelster, M. (2017). Financial penalties and bank performance. Journal of Banking & Finance, 79, 57-73. Maylor, H., & Turner, N. (2017). Understand, reduce, respond: project complexity management theory and practice. International Journal of Operations & Production Management. Mbama, C. I., & Ezepue, P. O. (2018). Digital banking, customer experience and bank financial performance. International Journal of Bank Marketing. Munro, L. T., &Ika, L. (2020). Guided by the beauty of our weapons: comparing project management standards inside and outside international development. Development in Practice, 30(7), 934- 952. O’riordan, J. (2017). The practice of human resource management. Research paper, 20. Olson, E. M., Slater, S. F., Hult, G. T. M., & Olson, K. M. (2018). The application of human resource management policies within the marketing organization: The impact on business and marketing strategy implementation. Industrial Marketing Management, 69, 62-73. Turner, R. (2016). Gower handbook of project management. Routledge Van Aartsengel, A., &Kurtoglu, S. (2016). A guide to continuous improvement transformation: Concepts, processes, implementation. Springer Science & Business Media. Zelenyuk, N., & Zelenyuk, V. (2021). Bank Performance Analysis (No. WP022021). School of Economics, University of Queensland, Australia.